XRP is a cryptocurrency that powers genuine-time gross settlements on the XRP Ledger (XRPL) blockchain. Builders David Schwartz, Arthur Britto and Mt. Gox founder Jed McCaleb began establishing the distributed ledger in 2011 to enhance cross-border payments.

The XRPL launched in June 2012 with XRP, the very same year money know-how company Ripple Labs was founded (originally called NewCoin, then OpenCoin, right before rebranding to Ripple Labs) by veteran Silicon Valley entrepreneur Chris Larsen and the 3 developers.

Immediately after the business was started, XRPL architects gifted 80 billion XRP tokens to Ripple for the corporation to start off creating on the community.

This Forkast explainer will examine:

What is Ripple?

San Francisco-based Ripple Labs is the operator of RippleNet, a payments and forex exchange network devoted to removing the hurdles and lags in the present money procedure with blockchain-powered innovations.

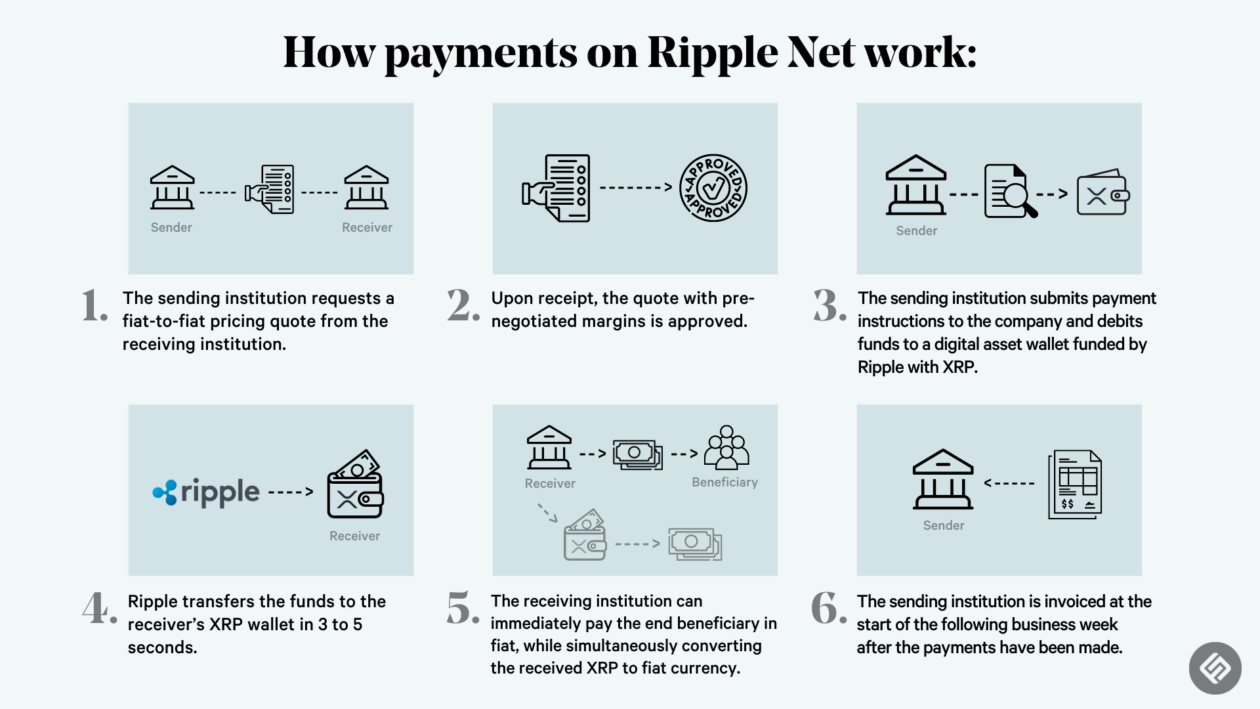

RippleNet was developed to provide an option to the SWIFT community by giving a lot quicker and more cost-effective cross-border payments by means of the XRPL and XRP.

The enterprise utilizes XRPL technology to enrich cross-border payments, liquidity and central bank electronic currencies (CBDC).

The XRP Ledger’s indigenous token — XRP

XRP is used as transaction fees in XRPL, cross-border transactions, international settlements and liquidity sourcing.

XRP has a highest provide of 100 billion tokens, with just about 50 % in circulation as of October 2022. The 100 billion XRP was pre-mined in January 2013, where by the founders retained 20%, 77.8% was allotted to Ripple Labs and .2% was airdropped on distinct boards.

Ripple initially placed 55 billion XRP tokens in an escrow account that even now had 45.7 billion as of October 2022.

Fiscal establishments can use XRP to bridge two currencies to facilitate more cost-effective and more quickly cross-border transactions. XRPL’s decentralized trade converts payments utilizing the most affordable forex trade order out there.

For these banks and institutions to use XRP’s payments technological know-how, they frequently be part of RippleNet economic network that operates on XRPL.

According to the Ripple whitepaper, the community delivers 3 to 5-next settlements and can handle all over 1,500 transactions for every second with an believed US$.0002 in transaction charges by its Special Node Lists (UNL) consensus system.

UNL is a list of validators reliable by a node operator. Every node operator chooses its have UNL, typically centered on a default set provided by a reliable publisher. UNL will help nodes choose the most trustworthy validators.

What helps make Ripple and XRP stand out?

Central banks can use the XRPL’s personal community to deal with and challenge CBDCs, with no making an entire community from scratch. The U.S. Digital Dollar Undertaking has recently introduced it is doing the job with Ripple to launch a pilot system to examine a U.S. greenback-centered CBDC.

Sustainability is a single of the major focuses of Ripple Labs and XRPL. The blockchain employs a special consensus system with lessened energy usage. For 60 million transactions, XRP consumes 474,000 kWh of electrical power, although Bitcoin wants 57.09 billion kWh, the ledger’s carbon calculator promises. XRP emits 270 metric tons of CO2 for the similar total of transactions, although the Bitcoin network emits 27.96 million metric tons of CO2.

Criticisms of Ripple

When Ripple Labs argues that XRPL is a decentralized, public ledger, the sub-penny transaction costs and quick settlements occur at the value of validator centralization. RippleNet has 139 lively validators, largely operate by fiscal establishments, a centralized tally when positioned beside the likes of Ethereum’s around-fifty percent million.

Even though any person can operate a validator node on XRPL, each node configures its have UNL. New validators simply cannot confirm transactions except they are element of a further node’s record. Thinking about that validators on XRPL receive no money incentives, the ledger is expected to maintain a centralized node construction.

In addition, the U.S. Securities and Exchange Commission (SEC) sued Ripple Labs in December 2020 for allegedly conducting a US$1.3 billion unregistered securities giving. The two are nonetheless battling it out in the on-going court docket case.

The 45% of overall XRP in existence is in an escrow account controlled by Ripple Labs. Some critics dread the mass amount of money of tokens held by a single entity places the cryptocurrency at threat of cost manipulation.

In August, Ripple Labs unlocked a billion tokens from the escrow account, foremost to XRP bleeding out 3.4% of its price in the future 24 hours.

What does the upcoming hold for Ripple & XRP?

Ripple Labs’ long term mostly is dependent on the final result of its ongoing legal battle towards the SEC. But XRP is not the only cryptocurrency at chance of getting a security in this landmark scenario. The consequence may well have rippling results on the entire cryptocurrency market and how tokens are classified.

Irrespective of the ongoing lawsuit, the local community has been actively acquiring new functions on XRPL. Some of the most promising developments consist of good contracts, non-fungible tokens (NFTs), and sidechains.

In March 2022, Ripple Labs fully commited 1 billion XRP as an extension of XRPL Grants, aimed toward advancing the enhancement of the XRP Ledger.

XRPL’s lower-price and rapidly cross-border settlements have been Ripple Labs’ key selling stage in onboarding money institutions to RippleNet.